In the vast and complex world of forex trading, one crucial factor stands out: the broker. So, what exactly is a forex broker? Simply put, a broker acts as an intermediary between you and the market, connecting buyers and sellers of currencies from around the world. In Vietnam, people often refer to brokers as forex trading platforms.

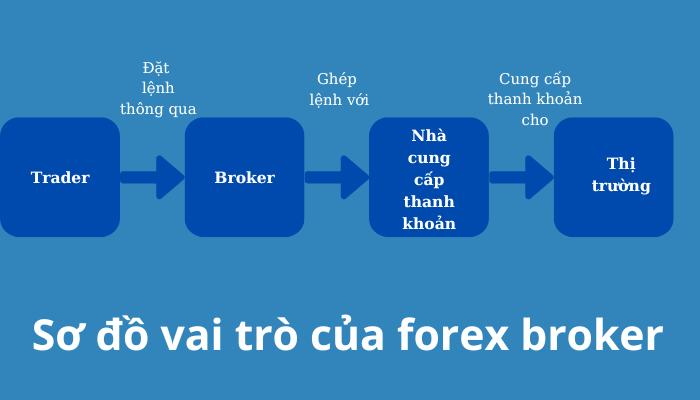

Each forex broker operates as a coordinator, matching your trades with liquidity providers such as large banks or financial institutions to ensure smooth and efficient transactions.

Without forex brokers, trading in the forex market would be nearly impossible, as finding buyers and sellers willing to trade with you would be extremely difficult. Understanding the role of a forex broker will give you more confidence in entering the market and making informed trading decisions.

Key Points:

- Forex Brokers as Intermediaries: Brokers act as intermediaries between currency buyers and sellers, facilitating transactions.

- Liquidity Providers: Forex brokers connect traders with liquidity providers such as large banks, creating market liquidity.

- Trading Platforms: A trading platform is software that allows traders to interact with brokers and execute trades, either through a downloadable application or a web browser.

- Role of Brokers: Brokers serve as intermediaries between traders and the market as well as between traders and liquidity providers, enabling transactions.

- Importance of Brokers: In the forex market, brokers play a crucial role in connecting buyers and sellers, providing access to liquidity providers, and supporting traders in market participation.

What is a Forex Broker?

The concept of a forex broker is often misunderstood, but it is essential to grasp their role in the forex market. A forex broker acts as an intermediary between buyers and sellers of currencies, facilitating transactions and providing access to the market.

Definition and Explanation

At its core, a forex broker is a middleman between you and the market, matching your buy or sell orders with other market participants. However, they also play a critical role in connecting you with liquidity providers such as large banks or financial institutions, ensuring that trades can be executed.

Read more: What is forex

A Brief History of Forex Brokers

Brokerage firms have existed for centuries, but the modern concept of a forex broker emerged in the 1970s with the introduction of floating exchange rates.

The rise of online trading in the 1990s and 2000s led to a boom in forex brokers, making market access easier for individuals. Today, hundreds of forex brokers operate globally, offering various services and trading platforms to cater to different needs and preferences.

The Role of Forex Brokers

Although forex brokers play a crucial role in facilitating trades, providing market access, and managing risk, their primary function is to act as intermediaries between traders and the market.

Facilitating Trades

A broker’s role is to connect buyers and sellers of currencies, ensuring smooth and efficient trade execution. They provide a platform where traders can buy and sell currencies, linking them with liquidity providers who execute their trades.

Providing Market Access

Any trader who wants to participate in the forex market needs access to a broker who can connect them with liquidity providers. Brokers provide this access, allowing traders to buy and sell currencies easily.

Additionally, with a broker, traders can access various markets and trading instruments, including major and minor currency pairs, commodities, and indices. This access helps traders diversify their portfolios and manage risk more effectively.

Risk Management

For traders, risk management is a crucial aspect of forex trading. Brokers help mitigate this risk by providing tools and resources to monitor and control trading activities.

One significant advantage of working with brokers is that they can help traders set stop-loss and limit orders, which can prevent excessive losses and lock in profits. Additionally, brokers often offer market analysis tools and research to help traders make informed decisions.

Types of Forex Brokers

Unlike other financial markets, the forex market does not have a centralized exchange. Instead, it operates through a network of brokers, banks, and other financial institutions. As a result, different types of forex brokers exist to cater to various trading needs and preferences.

| Type of Broker | Description |

| Dealing Desk Brokers | Act as market makers, buying and selling currencies from their inventory. |

| No Dealing Desk Brokers | Match trades with liquidity providers, eliminating the need for a dealing desk. |

| ECN Brokers | Connect traders directly to the interbank market, providing access to multiple liquidity providers. |

| STP Brokers | Pass trades directly to liquidity providers, bypassing a dealing desk. |

Dealing Desk Brokers

To better understand dealing desk brokers, consider a scenario where a broker acts as a market maker, buying and selling currencies from their inventory. This means they take the opposite position of a trader, profiting from the spread between the bid and ask price.

No Dealing Desk Brokers

In contrast, no dealing desk brokers do not act as market makers. Instead, they match trades with liquidity providers, eliminating the need for a dealing desk. This approach ensures that trades are executed at the best available prices, reducing conflicts of interest.

No dealing desk brokers generally have lower operational costs, which can result in tighter spreads and lower fees. Additionally, they are less likely to trade against their clients, fostering a more transparent and fair trading environment.

ECN Brokers

ECN brokers, another type of no dealing desk broker, connect traders directly to the interbank market, providing access to multiple liquidity providers. This ensures that trades are executed at the best available prices, reducing conflicts of interest and promoting transparency.

ECN forex brokers typically charge a commission per trade, which can be beneficial for high-volume traders. They also offer advanced trading features such as direct market access and anonymous trading, which may appeal to experienced traders.

How to Choose a Good Forex Broker

To ensure a successful and safe trading experience, it is essential to choose a reliable and reputable forex broker. Here are some key factors to consider when making your choice:

Regulation and Licensing

Regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and the Financial Conduct Authority (FCA) oversee forex brokers to ensure they operate fairly and transparently. Investors should look for brokers regulated by reputable agencies and verify their licenses to confirm legitimacy.

Reputation and Reviews

Beyond regulation, assessing a broker’s reputation by reading reviews from multiple sources, including forums, social media, and review websites, can provide insights into their reliability, customer service, and overall performance.

The importance of reputation cannot be underestimated. A broker with a poor reputation may engage in unethical practices such as price manipulation or withholding funds. Always prioritize brokers with a strong reputation and a proven track record of fairness and transparency.

Trading Conditions and Fees

An essential aspect of choosing a forex broker is understanding their trading conditions and fees. Look for brokers offering competitive spreads, reasonable leverage, and low commissions. Be mindful of any hidden fees, such as overnight swap fees or inactivity charges.

Với nhiều broker cung cấp các điều kiện giao dịch khác nhau, điều quan trọng là so sánh và đối chiếu các ưu đãi của họ để tìm ra broker phù hợp nhất với chiến lược giao dịch và ngân sách của bạn. Hãy chắc chắn đọc kỹ và hỏi nếu bạn không chắc chắn về bất kỳ khía cạnh nào của điều kiện giao dịch của họ.

Customer Support and Education

Successful trading also depends on the quality of customer support and educational resources provided by the broker. Look for brokers that offer multilingual support, comprehensive educational materials, and responsive customer service.

Forex trading can be complex and intimidating, especially for beginners. A good broker should provide access to educational materials such as webinars, tutorials, and market analysis to help you enhance your trading skills and make informed decisions.

Key Features to Look for in a Forex Broker

Not all forex brokers are the same. When choosing a broker, consider the following key features:

Trading Platform and Technology

The trading platform is the backbone of online forex trading. A good platform should offer advanced charting tools, reliable execution, and competitive spreads. Look for user-friendly platforms that are customizable and compatible with your devices, allowing you to run bot forex trading.

Currently, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the two most popular forex trading platforms worldwide.

Additionally, platforms like cTrader are highly rated for their user-friendly interface, fast order execution, and advanced trading features.

Account Types and Minimum Deposits

Brokers typically offer multiple account types, each with different features and requirements. Understanding these account types and their minimum deposit requirements is crucial when choosing a broker that fits your needs.

Account Type Minimum Deposit

Micro Account $100

Standard Account $1,000

ECN Account $10,000

Premium Account $50,000

One of the most important factors in choosing a broker is the account type and minimum deposit requirement. You should carefully consider the fees associated with each account type and ensure they align with your trading goals.

Currency Pairs and Market Access

Access to a wide range of currency pairs is essential for forex traders. Look for brokers that offer major, minor, and exotic currency pairs, as well as access to emerging markets.

Forex brokers provide access to different markets, including spot forex, futures, and options trading. Make sure your broker offers the markets you are interested in trading.

Security and Data Protection

Features such as two-factor authentication, SSL encryption, and segregated accounts are essential for protecting your personal data and trading funds. Account security should be a top priority when selecting a broker.

Understanding the security measures in place can give you peace of mind and protect your trading account from potential threats. Security should never be overlooked, and you should always prioritize it when choosing a broker.

Conclusion

It is clear that forex brokers play a crucial role in the forex market, acting as intermediaries between buyers and sellers of different currencies. They connect traders with liquidity providers, enabling them to buy and sell currencies. Through trading platforms or software, traders can interact with a forex broker to facilitate their transactions. In short, a forex broker provides the necessary infrastructure for traders to participate in the forex market, making them an indispensable part of the trading process.

FAQ

What is a Forex Broker?

A forex broker is an intermediary between buyers and sellers of different currencies in the forex market. They act as a middleman, connecting buyers and sellers with liquidity providers such as large banks or financial institutions to facilitate trades.

What is the Role of a Forex Broker?

The role of a forex broker is to match buyers and sellers of currencies, acting as an intermediary between them and the market. They also connect traders with liquidity providers, enabling efficient trade execution.

What is a Liquidity Provider?

A liquidity provider is an entity that supplies a large amount of currency to the market, creating liquidity that allows traders to buy and sell currencies easily. Examples of liquidity providers include major banks and financial institutions that trade currencies on a large scale.

How Do I Interact with a Forex Broker?

You can interact with a forex broker through a trading platform or software, which can be downloaded from the internet and installed on your computer. Some brokers also offer web-based trading, allowing you to trade from any computer without downloading software.

What is a Trading Platform?

A trading platform is software that allows you to buy and sell different currencies in the forex market. Through this software, you can execute trades, monitor your account, and access various trading tools and features.